child tax credit october 2021 delay

An IRS glitch delayed the monthly payment for parents at the heart of Democrats agenda. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

What If I Am Separated Or Divorced What If I Have Joint Custody Of My Child Who Will Get The 2021 Child Tax Credit And Advance Payments Get It Back

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

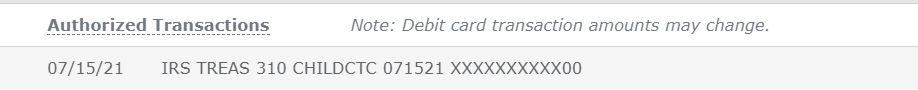

. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. To reconcile advance payments on your 2021 return. A technical issue that delayed last months payments for a small number of advance child tax credit recipients.

The credit is. Some families in need said the checks have been a saving grace. It pays up to 300 per child.

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks. If your payment is missing due to a delay because you misplaced it or if you provided the. That means the October November and December payments for affected parents will be reduced by 10-to-13 per child.

The IRS on Friday release declared that due to a technical issue the payments for the last month got delayed for a small number of advance child tax credit recipients in September has now been sorted while explaining about the fourth monthly payments of the program. The state of Connecticut is now accepting applications for the 2022 child tax rebate. The IRS says the programs fourth monthly payment is already hitting Americans bank accounts after a technical issue last month caused delays for some recipients.

The governor announced the application period for the 2022 Connecticut Child Tax Rebate will accept applications through July 31. Connecticuts child tax credit program is now taking applications Gov. By Brent Addleman.

They are scheduled to receive 90 billion in payments in October. Why your Child Tax Credit might have been delayed. The outlet further stated the IRS has since sent out the delayed payments although parents continue to wait.

But the income. The total credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17 with an income cap of 150000 for couples. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

The Internal Revenue Service failed to send child tax credit payments on time to 700000 households this month and some are still waiting for their full benefit. Since July the IRS has sent the payments to roughly 35 million households on the 15th of each. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

Updated 659 PM ET Wed September 22 2021. It is estimated that. Get your advance payments total and number of qualifying children in your online account.

CHICAGO NewsNation Now Families across the country are starting to receive their October child tax credit. Enter your information on Schedule 8812 Form. By Christine Stuart June 1 2022 930 am.

Mom Meredith Jones stated The child tax credit that hasnt been distributed properly the last two months She reported missing 200 in September and over 300 in October. Please look at the time stamp on the story to see when it was last updated. He IRS started sending out the fourth lot of Child Tax Credit payments on October 15 and millions will have already received this money either via direct deposit or by mail.

ABC10 viewers heard from some people at home saying they havent received their last Child Tax Credit payment. That means if a five-year-old turns six in 2021 the parents will receive a. The rebate was developed within the budget bill Lamont signed last month and provides a rebate of up to 250 per child.

The phaseout range for the basic 2000 child tax credit for 2021 starts at a modified adjusted gross income of 400000 for married filing jointly and 200000 for other filers. Affected parents will receive letters explaining what happened. Parents of a child who ages out of an age bracket are paid the lesser amount.

Child Tax Credits May Be Missing or Delayed for Several. This isnt a problem to do. After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some.

Millions of families who rely on the monthly child tax credit could see delays. The program which is part of the budget will provide taxpayers. Filing a trace for October Child Tax Credit payment.

Child Tax Credit Payments Here Are The Dates You Ll Get Your Next Stimulus Payments Worth 900 Per Kid

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Child Tax Credit Payments Start This Week Here S How The Irs Is Trying To Make Sure The Neediest Families Don T Miss Out Cnn Politics

Tax Insights Timely Industry News Thought Leadership

Child Tax Credit When Will Your October Payment Show Up Cbs Detroit

Child Tax Credit When Will Your October Payment Show Up Cbs Detroit

Self Employeds And Household Employers Process To Repay Deferred Social Security Tax Nstp

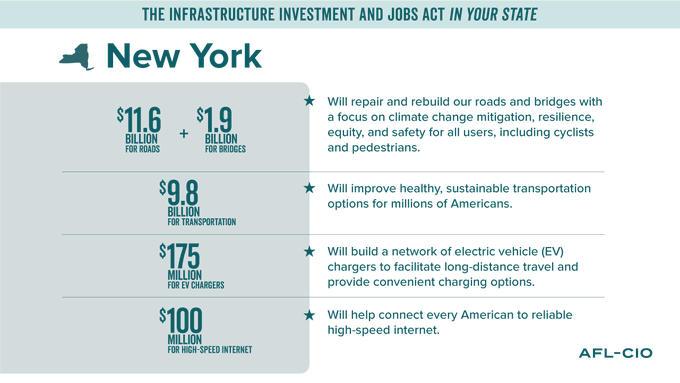

Working People Respond To Passage Of Historic Infrastructure Legislation Afl Cio

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Child Tax Credit Payments Start This Week Here S How The Irs Is Trying To Make Sure The Neediest Families Don T Miss Out Cnn Politics

Missing A Child Tax Credit Payment Here S The Irs Phone Number

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Tax Filing Deadline For 2021 Returns

Child Tax Credit Payments Start This Week Here S How The Irs Is Trying To Make Sure The Neediest Families Don T Miss Out Cnn Politics

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Child Tax Credit Payments Here Are The Dates You Ll Get Your Next Stimulus Payments Worth 900 Per Kid

2022 Monthly Advance Child Tax Credit Ctc Refund Payments Status Via 2021 Tax Filing Latest Updates And News On Path Act And Direct Deposit Dates Aving To Invest

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Child Tax Credit When Will Your October Payment Show Up Cbs Detroit